Let’s be honest: traditional banks weren’t built for the creator economy. They’re built for 9-to-5s, steady paychecks, and credit scores — not the vibrant, unpredictable, and fast-paced lives of creators, freelancers, and digital entrepreneurs.

In 2025, with the creator economy projected to surpass $500 billion, it’s time creators start banking like it.

1. 💸 Traditional Banks Don’t Understand Creator Income

Creators don’t get paid every two weeks. You might get five brand payments in one month and zero the next. Unfortunately, traditional banks still judge your financial health based on outdated systems like W-2 income or credit scores — which often leaves creators overlooked or denied access to capital.

Creator-first banks, like Bump, evaluate your income based on your actual content performance, deposits, and online presence — not just a credit report. That means more access, less judgment.

2. ⏱️ Faster Access to Brand Payments = Peace of Mind

Waiting 30, 60, or even 90 days to get paid by brands? That’s a creator’s nightmare. Creator-friendly banks are solving this by offering instant or accelerated payments, letting you get paid when you need it — not when a brand finally gets around to it.

With Bump, for example, creators can ditch the chase and get what they’ve earned — fast.

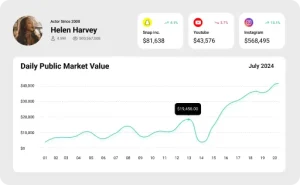

3. 📊 Know Your Market Value

One of the most empowering features of creator-focused platforms is real-time insight into your market value. How much should you be charging for a sponsored post? A YouTube collab? A TikTok campaign?

Banks that understand creators help you answer those questions with data-backed tools that help you charge what you’re worth — not guess what you think you’re worth.

4. 🌱 Build Wealth Like a Business

You’re not just an influencer — you’re a business. Creator-friendly banks offer more than just checking and savings accounts. They help you:

- Earn interest on your deposits

- Get funding to grow your brand

- Set up automated savings or tax buckets

- Access investment opportunities that work for your lifestyle

It’s time creators started building long-term wealth, not just one-time brand checks.

5. 🧘 Less Stress, More Freedom

Financial anxiety is real. In fact, over 60% of creators report feeling stressed about income inconsistency. When you bank with a platform that understands your world, you feel more in control, more supported, and more confident in your growth.

In 2025, creators are more powerful than ever — but your bank should be just as powerful, too.

Creator-focused banks are built for your world, your work, and your dreams. Whether it’s faster payments, better funding options, or financial tools made for your business model — choosing a platform that “gets it” isn’t just smart… It’s essential.

👉 Ready to bank like a creator? Check us out — we’re built by creators, for creators.